How Does a DUI Affect Your Auto Insurance Rates?

Last Updated: September 18, 2024

A DUI in Canada is covered under section 320.14 of the Criminal Code, found in Part VIII.1. Part VIII.1 covers “Offences Relating to Conveyances.”

A DUI charge involves operating a vehicle while impaired by drugs or alcohol. Under the Criminal Code, you can also face serious consequences including fines, licence suspensions and jail time. Further, your auto insurance rates can be impacted.

In Ontario, in addition to being charged under the Criminal Code for Impaired Driving, Ontarians can face penalties under the Highway Traffic Act, starting at $250.00 for a first offence and going up to $450.00 for a third or subsequent.

Consequences of a DUI under the Highway Traffic Act can include immediate licence suspensions, a fine, mandatory educational or treatment programs, the impoundment of your vehicle.

All of these consequences highlight the seriousness of a DUI in Ontario. The goal of this article is to highlight the potential financial consequences of a DUI on insurance.

Immediate Impact of DUI on Auto Insurance

After a DUI conviction, you are required to informer your insurance company of your conviction. If you do not, they can render your insurance void as per the insurance policy.

There will then be a dramatic increase in your insurance rates. This is because people with DUIs are viewed as high risk from insurance companies – they believe there is a chance that you will get into another DUI or traffic incident while under their coverage, and thus need the money to deal with this in case such an incident occurs.

There can also be immediate consequences to your insurance, including non-renewal and cancellation, when your insurance company no longer wishes to provide you insurance due to your DUI and the perceived risk they see for you.

How Does a DUI Affect Auto Insurance Rates?

In Ontario, the premiums can range from $2,000 to $10,000 a year for those with a DUI conviction. This is equivalent to 3-5 times what you were previous paying before.

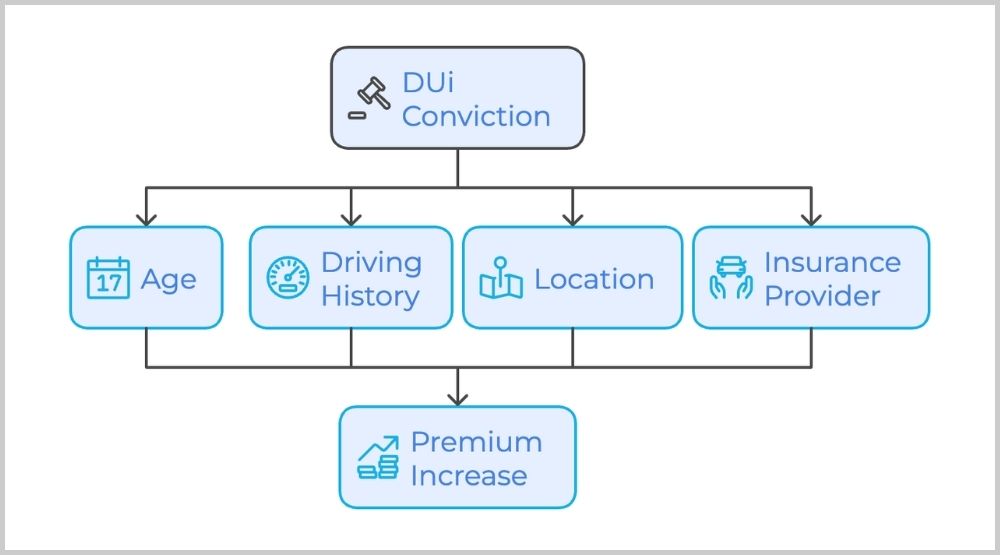

Not all increases are the same and will depend on various factors. These factors include:

- Age: Insurance companies are more likely to raise rates for teenagers or young adults, as they are often seen as more high risk in terms of getting into future collisions compared to middle-aged adults or the elderly.

- Driving History: A person with a clean driving history is expected to face a lower increase than those who have repeated infractions on their driving record due to the perceived risks involved in insuring these drivers.

- Location: Different locations are viewed as having different levels of risk and thus can impact the level of increase in insurance rates. Those living in busy cities often face bigger increases than those living in less populated areas.

- Insurance Provider: Every insurance provider is different. As such, they will provide different increases after a DUI. This opens the door to potential exploration of other insurance options if your insurance company increase your rates too much.

How Long Does a DUI Affect Auto Insurance Rates?

The length of the effect of a DUI on your auto insurance rates will depend on how long the DUI is on your driving record. The length it is on your driving record can vary depending on the circumstances of your DUI.

- 3 years: A first time DUI in Ontario that does not have any licence suspension associated with it will stay on your driving record for three years after conviction.

- 6 years: If your first DUI has a driving record associated with it, the conviction will stay on your record for six years after conviction.

- Forever: Multiple DUIs will stay on your driving record indefinitely.

Even though a DUI can be removed from your driving record after 3 years, it is considered in rate calculation up to 6 years. Factors such as state laws or repeat offences can impact this duration further.

Options for Managing Higher Insurance Rates After a DUI

There are various things you can do to avoid high insurance rates after a DUI conviction

- Shop around: Not all insurance providers are identical and will provide varied rates despite your DUI conviction. You may wish to do a little shopping around or seek out high-risk insurance.

- Clean driving record: The key to lowering insurance rates is a clean driving record post-conviction. Though it will take a few years for the impact of the DUI to decrease, a clean driving record will help you return to your pre-conviction rates.

- Defensive driving courses: A potential mitigating factor that insurance companies may appreciate is educational courses. You can take courses such as defensive driving or alcohol education programs that may help decrease your rates.

Can You Lower Your Insurance Rates After a DUI

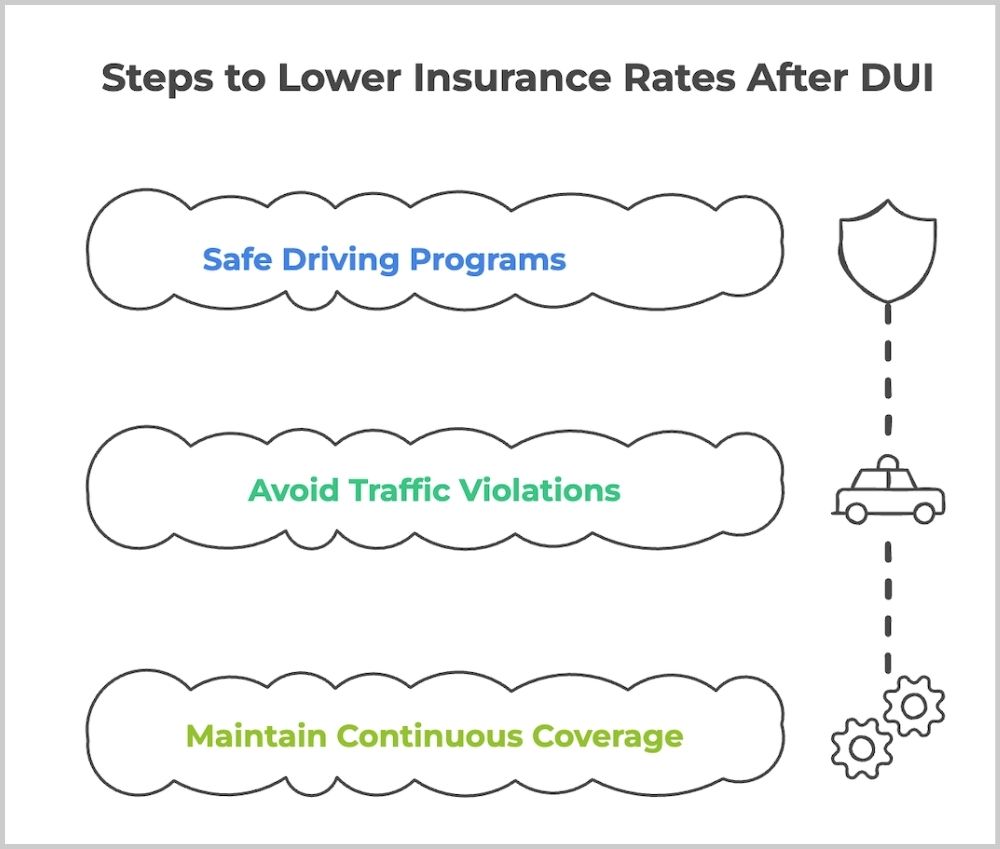

Though it may be challenging, it is 100% possible to decrease your auto insurance rates after a DUI conviction. In addition to immediate steps you can take, such as finding a new provider or switching to high-risk insurance, you can also look for rate reduction through bundling insurance policies. In addition, there are steps you can take to lower insurance rates overtime, including:

- Safe driving programs: There are various educational programs you can take to improve your insurance rates. These programs also can reduce demerits, and overall reflect well on your driving record.

- Avoid traffic violations: Avoiding further dings to your driving record will be very important. The ultimate goal is to make it so once the DUI is removed from the record, there is no leverage upon which the insurance company can continue to increase your rates.

- Maintain continuous coverage: though it may be expensive at first, it is important to keep continuous insurance coverage throughout the length of the DUI on your record. This will allow the insurance company to see your improvement in terms of the safety of your driving, which will inevitably lower rates.

Impact on Other Insurance Policies and Long-Term Financial Implications

Though the focus of the article is auto insurance, like other areas of insurance, a DUI does not only impact one area. A DUI can impact other types of insurance, such as life or health insurance as well, which can be difficult when trying to move past the incident and recover financially.

Further, there are other financial impacts outside the realm of insurance. These can include difficulties with loan applications, credit score implications, and an impact on employment and job prospects.

Get Help With Your DUI

A DUI can have a dramatic and immediate impact on your insurance rates and financial well-being in addition to the fines and costs already incurred fighting a DUI. The article helps understand the consequences of a DUI in Ontario and highlights the importance of avoiding a DUI in the first place, along with what to do to help your insurance rates after conviction.

Call the experienced criminal defence lawyers at Defend Your DUI for personalized advice on your case.

Get A Free Consultation

"*" indicates required fields